2024 Sep Ira Limits

2024 Sep Ira Limits. Sep ira contribution limits for 2023. 2024 simple ira and simple.

Here’s the breakdown for the 2024 ira contribution limit changes. As mentioned, the overall sep ira contribution limit for 2024 is $69,000, but there are a few things to unpack here.

In 2023, You Can Contribute $22,500 To A 401(K) And Up.

Single, head of household, or married, filing separately:

The Tax Deductibility Of That Contribution, However, Depends On Your Income.

The 2024 income limit for singles has increased from $153,000 to $161,000.

Sep Ira Contribution Limits [2023 + 2024] Written By.

Images References :

Source: meldfinancial.com

Source: meldfinancial.com

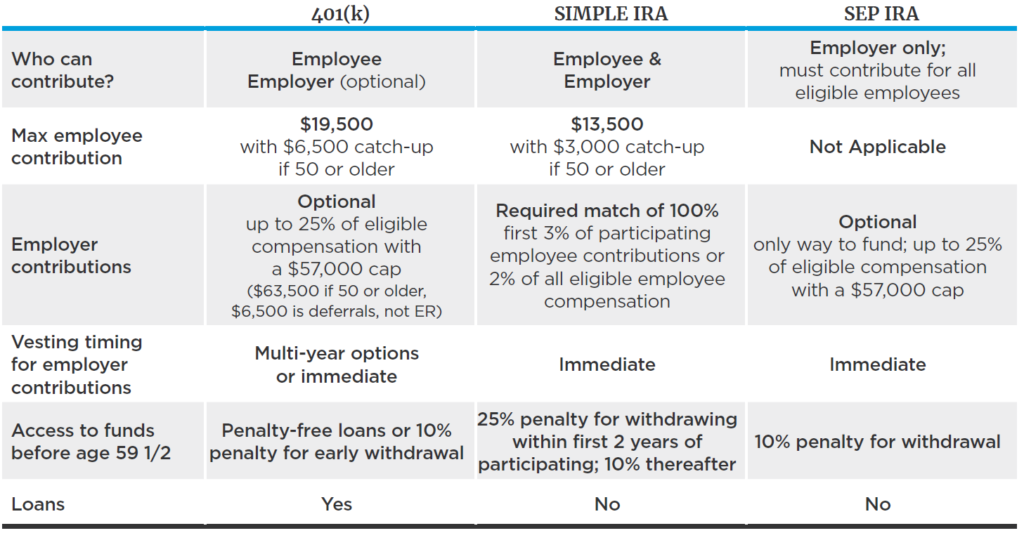

IRA Contribution Limits in 2023 Meld Financial, The sep ira is one of the best ways for small businesses and individual business owners to help employees save for retirement, and they’ll be able to contribute even more in. The maximum amount an employer can.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000. $66,000 (in 2023), or $69,000 (in 2024) the sep ira is an employer contribution rather than an employee contribution, so it’s made by the company rather than the individual.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, The tax deductibility of that contribution, however, depends on your income. As mentioned, the overall sep ira contribution limit for 2024 is $69,000, but there are a few things to unpack here.

Source: www.marinerwealthadvisors.com

Source: www.marinerwealthadvisors.com

Discover the Benefits of Establishing a 401(k) over a SEP or Simple IRA, Sep ira contribution limits are higher than most options, which a max contribution limit of up to $66,000 for 2023 and $61,000 for 2022. If you are 50 and older, you.

Source: elinorewglad.pages.dev

Source: elinorewglad.pages.dev

2024 Roth Limit Rory Walliw, The sep ira contribution limit for 2023 is 25% of eligible employee compensation, up to $66,000. You generally must be at least 59 1/2 to take withdrawals from the account without paying a 10% penalty.

![SEP IRA Contribution Limits [2023 + 2024]](https://wealthup.com/wp-content/uploads/SEP-IRA-contribution-limits.jpg) Source: wealthup.com

Source: wealthup.com

SEP IRA Contribution Limits [2023 + 2024], The irs increased the 2024. $66,000 (in 2023), or $69,000 (in 2024) the sep ira is an employer contribution rather than an employee contribution, so it’s made by the company rather than the individual.

Source: udirectira.com

Source: udirectira.com

2024 Contribution Limits for IRA & Solo 401(k) Accounts, Single, head of household, or married, filing separately: Sep ira contribution limits for 2023.

Source: www.linkedin.com

Source: www.linkedin.com

Unlock Your Financial Future A Quick Guide to 2024's IRA and, Rules and limits to open a sep ira for 2024. If you are 50 and older, you.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

SEP IRA Contribution Limits with Calculator for Self Employed Persons, Also, sep ira account owners may take distributions at. For 2024, the ira contribution limits.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, Should i contribute to my sep ira or my 401(k)? The maximum amount an employer can.

In 2024, Those Contribution Limits Increase To $7,000 And $8,000, Respectively.

Should i contribute to my sep ira or my 401(k)?

If Less, Your Taxable Compensation For The Year.

For 2022, 2021, 2020 and 2019, the total contributions you.